Thanks to the interest tax shield, Company B can essentially save 20% of that $10 million, which amounts to a $2 million. Both companies are identical in all aspects other than debt and interest payments. Companies can default or become insolvent if they’re unable to meet their interest expense or debt repayment obligations.

- It’s particularly useful when a company’s debt-to-equity ratio is expected to change significantly over time or when complex financing is involved.

- The good news is that calculating a tax shield can be fairly straightforward to do as long as you have the right information.

- The most obvious benefit of an interest tax shield is to bring monetary savings for individuals and corporate taxpayers.

Does This Mean All Corporate Debt Can Be Good?

For instance, if your allowable interest tax cost is $2,000 and the effective tax rate is 25%, then your interest tax shield will be $500. The first step in calculating the interest tax shield is to know the limit of tax-deductible interest expenses. For instance, you can deduct interest costs of up to $ 2,500 on a student loan per year.

Limited Deduction Allowance

Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayer’s obligations. In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayer’s adjusted gross income, depending on the specific circumstances. For donations to qualify, they must be given to an approved organization. The deductible interest paid on debt obligations reduces a company’s taxable income. There are many examples of a tax shield, and it often depends on the tax rate of the corporation or individual as well as their tax-deductible expenses.

Step 3: Calculate the APV

This is the fundamental value of the business operations without considering any effects of debt financing. The second part of APV accounts for the PV of all financial side effects resulting from the company or project’s debt. These effects primarily include tax shields, which are the tax savings generated by the tax deductibility of interest payments on debt. Since interest expenses are tax deductible, tax shields are crucial because businesses can profit from the formulation of such activities.

When it comes to understanding the tax shield definition, understanding how to calculate it under different scenarios is important. This is a huge benefit for individuals since the home is usually the largest asset any one person will ever purchase. It also means companies have more money available to reinvest back into the business for higher growth. As highlighted above, unmanageably high interest and debt payments can force a firm into insolvency or bankruptcy. And for simplicity, let’s assume that there are no messy accounting conventions distorting profit from cash flow. Thus, without the interest payment, the company A effectively pays $2 million in additional tax.

Can personal expenses ever be considered deductible?

To calculate a tax shield, you need to know the value of your tax-deductible expenses and your own individual tax rate. A tax shield is a legal way for individual taxpayers and corporations alternative fuel to try and reduce their taxable income. The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses.

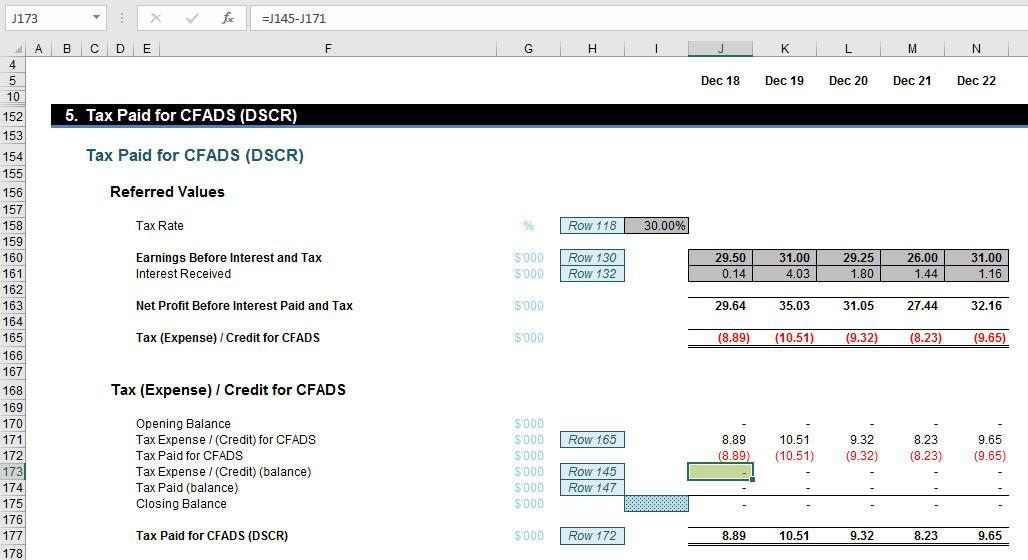

The interest tax shield is only applicable when the company’s earnings – specifically, earnings before interest and taxes (EBIT) – is larger than the actual expenditures on interest. Rather, it’s about one particular tool – the interest tax shield – and how it’s used to optimise a company’s tax liability. The job of a good CFO is to improve the company’s financials by optimising the taxable income so the company isn’t paying more tax than it needs to. And corporate entities have even more income streams and many more headwinds when it comes time to prepare their tax statements.

The tax shield is an incentive for investing because it allows one to receive tax benefits before an investment generates profits. Let’s consider a practical example to see how a tax shield works in real life. Imagine a small business that invests in machinery for production purposes. The cost of the machinery is $50,000, and it has an expected useful life of 10 years. Assuming a straight-line depreciation method, the business can deduct $5,000 ($50,000 divided by 10) from its taxable income each year for ten years as a depreciation expense.

Although you can use a term loan for any purpose but specific loans like a vehicle mortgage must be spent categorically. Then, you must spend the loan amount specifically taken for a purpose. For example, if you borrow money for a new machine purchase and spend it on building renovation, it will not qualify. You can follow these simple steps to calculate the interest tax shield. For both companies, the financials are the same until the operating income (EBIT) line, where each has an EBIT of $35m. Based on the information, do the calculation of the tax shield enjoyed by the company.

This can make borrowing more attractive for companies and encourage them to take on more debt than they might otherwise. However, it is important to note that the tax benefit of the interest tax shield can vary based on a company’s tax rate, making it more or less advantageous for different companies. A company’s taxable income is decreased by the interest paid that is deductible on debt commitments. The overall amount of tax the company owes subsequently lowers as a result. However, only situations in which the company’s earnings, specifically its earnings before interest and taxes (EBIT), exceed its actual interest expenses qualify for the tax shield. Therefore, a business must show profitability before it begins to make use of the interest tax shield.