This knowledge will empower you to make more informed decisions, optimize your operations, and ultimately drive sustainable growth for your company. Profit percentage is more than just a financial metric it’s a powerful tool that can drive strategic decision-making and business growth. By mastering the calculation and interpretation of profit percentage, you equip yourself with invaluable insights into your business’s efficiency and potential. Determining what constitutes a “good” gross profit margin is not a one-size-fits-all proposition, as it varies by industry, business size, and economic conditions. However, businesses aim to achieve a gross profit margin that ensures profitability while remaining competitive in their specific market. Most businesses choose to calculate gross profit as part of their quarterly accounting.

Calculating Gross Profit

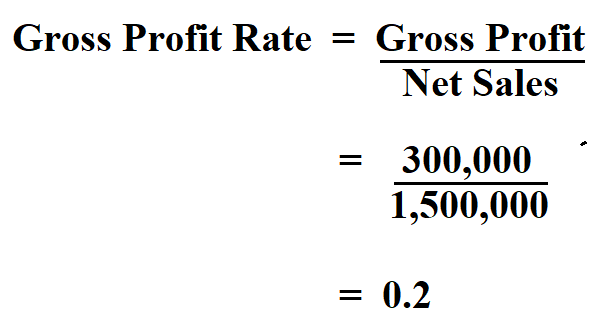

Sales revenue may be impacted if inventories are low due to teams’ failure to reach production targets, which ultimately results in changes in the gross profit rate. As a result, tracking this measure might be useful for determining how efficiently things are produced and distributed. In other words, the GPP allocates the directly assignable cost of production before capturing the profit. Additionally, it calculates the gross profit made from each dollar of revenue. Gross profit is revenues minus cost of goods sold, which gives a whole number.

FAQs About How To Calculate Gross Profit

To fully understand gross profit, however, you have to understand the difference between variable and fixed expenses. When calculating the net margin, you’ll find out how much of each dollar you earn through sales stays in your pocket. So a 25% net profit margin would mean you keep 25 cents of every dollar you make in sales. A software company might have a higher profit percentage than a grocery store due to lower overhead costs.

- After reviewing his expenses for the year, Garry determined his COGS is $650,000.

- Gross profit and gross margin are the two terms that are widely used in the financial sector.

- The gross profit ratio is a measure of the efficiency of production/purchasing as well as pricing.

- Monica owns a clothing business that designs and manufactures high-end clothing for children.

- Such businesses aim to cover their fixed costs and have a reasonable return on equity by achieving a larger gross profit margin from a smaller sales base.

Step 1: Determine Your Calculation Period

One such metric, gross profit, plays a pivotal role in evaluating a business’s financial performance. The 2 components of gross profit—revenue and cost of goods sold—each offer an opportunity to examine business strategy. The first step in calculating gross profit is determining the company’s revenue. This is the total amount that your company generated from sales before any costs or deductions are included. It shows how effectively you use your resources—direct labor, raw materials, and other supplies—to produce end products.

How to Calculate Gross Profit Percentage in 5 Steps

For example, if a company’s gross profit is 25% lower than its competitor’s, it should investigate all revenue streams and each component of COGS to identify the cause. Costs such as utilities, rent, insurance, or supplies are unavoidable and relatively fixed, while gross profit is dictated by net revenue and cost of goods sold. This means a company can strategically adjust more elements of gross profit than it can for net profit.

Gross Profit Margin: Formula, Calculation and Example

The gross profit percentage could be negative, and the net income could be coming from other one-time operations. The company could be losing money on every product they produce, but staying a float because of a one-time insurance payout. Gross profit margin is calculated by subtracting the cost of goods sold from your business’s total revenues for a given period. Good gross profits vary by industry, and new businesses typically have a smaller gross profit ratio.

Smaller businesses may choose to calculate gross profit monthly so they can adapt more quickly. Learn more about how to calculate gross profit margin accounting cycle steps and examples what is accounting cycle video and lesson transcript and its relevance to your business. To calculate the gross profit margin, we then divide by revenue and multiply by 100 to get a percentage.

Your gross profit margin will show whether a product makes the business money. A high gross profit ratio indicates that a product generates profit above its labor and other operating costs. On the other hand, a low gross profit margin will show that your sale price is not much higher than the cost required to produce the product. This could indicate that your pricing strategy is off, costs aren’t well-controlled, or raw materials and labor aren’t used efficiently.