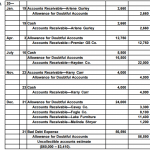

For instance, if your company pays double time instead of time and a half, you’d multiply an employee’s regular hourly wage by two. Custom user roles and permissions let your clients manage access to sensitive information and delegate work to specific employees. Find everything you need from employee benefits to hiring and management tools. QuickBooks monthly plans range in price from $20.00 to $200.00 per month. Automatically sorts business expenses and receipts into tax categories, view Sales Tax Liability reports, and automatically calculate quarterly taxes. Have a look at our article on the best accounting software providers for detailed comparisons between QuickBooks, FreshBooks, and Sage 50cloud.

QuickBooks Online Pricing Plans

QuickBooks Desktop Premier Plus includes a full list of basic bookkeeping tools and features. Plans for up to five users are available and payroll can be added for an extra $500/year, plus $5/employee each month. Daytime live chat and phone support are available during weekdays.

Find a plan that’s right for you

While the latter is eligible for overtime pay, the former is not. In this section, we’ll look more closely at what separates exempt vs. nonexempt employees. If your employees are on different pay period schedules, calculating overtime can be a bit more complex, but no matter the pay frequency, overtime is always always based on a seven-day workweek. In general, employees who work more than 40 hours in a week qualify for overtime pay. There are some exceptions that depend on job duties, how compensation is determined (salaried vs. hourly employees), and how much an employee is paid. In this article, we’ll take a closer look at what overtime is, how much overtime pays, and who qualifies for overtime.

QuickBooks Online Plans Comparison Quiz

It combines inventory management, payroll and sales tracking as part of its comprehensive suite of features. In this article, we’ll compare the available QuickBooks Enterprise pricing plans in order to help you select the best match for your business. QuickBooks Desktop pricing is based on an annual subscription model. Unlike QuickBooks Online plans, which each come with a set number of users, QuickBooks Desktop Premier Plus comes with one user license.

QuickBooks Support:

- However, many nonexempt employees earn more than the salary threshold required by federal law.

- It includes payroll processing, which allows you to calculate and track payroll taxes, and it lets you track assets and liabilities and use automated sales tax on invoices.

- Many accounting professionals also offer set-up services, ongoing support, and advisory services to help your small business work successfully on QuickBooks.

- So, once a worker reaches 40 hours in a week, they must receive time and a half for every additional hour worked.

Additionally, it enables you to record and track payments made to 1099 contractors. All of these small costs can add up, making your end bill higher than the predictable $30-$200/month fee. Xero is most often used by small to medium-sized businesses (SMBs). Although it has the lowest starting price, at $12 per month, it can be a little more difficult to navigate than payment and expense: what’s the difference QuickBooks or FreshBooks. Because there is an unlimited number of users that can use the program, you can maximize its use if you have a team of professionals who need access to your accounting software. For Xero’s Early plan ($13), the number of invoices that users can send each month is capped at 20, but for all other Xero plans, users can send unlimited invoices.

Intuit Mailchimp Previews AI-Powered Revenue Intelligence System, Launches SMS Marketing Tools in the UK

This customer said that although QuickBooks was a useful product with easy access for her accountant, the learning curve was too great for her and she was not happy with the price hike. In addition to the features offered by the Gold and Platinum plans, QuickBooks Enterprise Diamond adds Assisted Payroll and QuickBooks Time Elite. A Salesforce CRM Connector is available for this plan for https://www.business-accounting.net/ an additional monthly fee and setup fee. Your business size and structure will determine which QuickBooks Online plan is best. If you’re a single freelancer, you won’t need to manage any other employees, and you won’t need to track many sales (if any) – so the Self-Employed Plan is best for you. We’ve ranked the best self-employed accounting software, and QuickBooks is at the top.

These industry editions add customized features and reports to fit your business needs better. QuickBooks pricing is based on your plan, the number of users, add-ons, and other factors. See what you’ll expect to pay for a subscription to QuickBooks Desktop. QuickBooks https://www.accountingcoaching.online/what-are-fixed-manufacturing-overhead-costs/ Online allows up to 25 users on its most expensive plans. However, the QuickBooks Desktop Pro requires you to pay $299 for every additional user, up to a maximum of three. Desktop Premier and Enterprise, meanwhile, allow up to five and 30 users, respectively.

I have customised the reports to show the time period and categories that are useful for our business. Manage multiple businesses with one login with Quickbooks multi-files. Run multiple accounts with one login, one password, and at a discounted rate. A Live Bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books.

A nonexempt employee is any worker who doesn’t meet the exemptions listed above. Additionally, to be considered exempt, an employee must earn at least $684 per week. So, while certain employees may perform some of the job duties listed above, they’re considered nonexempt if they don’t meet the income threshold. Marketers worldwide can sign up for the revenue intelligence early access updates to apply AI to optimize their targeting and content strategy in practical, meaningful ways soon. Mileage tracking is available on QuickBooks Self-Employed and QuickBooks Online on iOS and Android only. Identify which of your current QuickBooks Online clients are right for Advanced and how it can help grow their business.

When you’re ready to set up and run payroll in QuickBooks Online, you can sign up directly through the QuickBooks Online dashboard and select your subscription plan directly from there. After you answer a few basic questions, you can then start adding your employees. Here, you’ll add their information and pay rate along with withholdings, deductions, and other information. After that, you can add your worker’s comp policy and set up your payroll taxes.