The LLC should file annual reports or biennial reports that give updates on current members, business locations, and other changes. The growth potential of your business operations can influence your decision between forming an LLC or an S corp. While LLCs provide a flexible management structure and pass-through taxation, they may face limitations in raising capital due to their inability to issue stock.

Take Control of Your Taxes

It can help you compare the potential tax savings between filing as an LLC vs. S Corp. By using this tool; you can get an idea of how much you might owe in taxes and see how the tax benefits of an S Corp compare to those of an LLC. After subtracting his business write-offs for the year, he’s got $30,000 in leftover profit. But because his business is new, he simply can’t afford to pay himself that much.

Reduce your federal self-employment tax by electing to be treated as an S-Corporation

However, S-corps may require more paperwork, and choosing the right strategy is more complex when considering an S-corp over an LLC. As LLCs don’t normally provide significant tax differences from a Sole Proprietor, the tax comparison remains the same as our previous example. The answers to these questions can help you determine the fit of an LLC designation or S corp—classification for your business. With an LLC, you could have various classes of equity and various degrees of participation in your equity, Paris explained, unlike an S-corp where you can only have a single class of stock. The main difference between S-corps and LLCs is that LLCs are generally more flexible than S-corps.

Taxes on your distributions

Forming a Limited Liability Company (LLC) but electing to be taxed as an S Corporation. Regardless if you’re self-employed or an employee, you have to pay Social Security and Medicare taxes to the government. After Atlas forms the company, we’ll automatically issue shares to the founders and help you purchase them so you formally own your share in the company. Atlas what changes in working capital impact cash flow allows founders to purchase their shares with intellectual property in one click and reflect this in your company documents, so you don’t need to mail and track cash or check payments. Atlas founders also gain access to exclusive discounts at leading software partners, one-click onboarding with select partners, and free Stripe payments processing credits.

Owner employment

If you do business in other states as an LLC, you’ll need to register to conduct business in each state, which will cost an additional foreign business registration fee. Knowing the difference between an S-corp vs. LLC can help you decide which business structure works best for you and bring you benefits that align with your goals. Having a formal business structure is one of the first steps to building a successful business. Get your business’s finances and taxes organized with accounting software like QuickBooks, which lets you focus on running your business confidently. Limited liability companies are more flexible when it comes to ownership. They can have an unlimited number of members, which can include individuals, other LLCs, corporations, and even foreign entities.

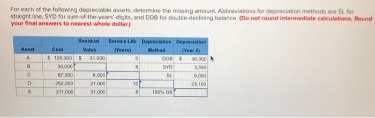

S Corporations simply have more complex tax rules, when compared to sole proprietorships. S Corp owners must manage more types of taxes, including the overhead of running quarterly payroll. In addition, S Corps may be expected to comply with state-level business filings, increasing the need for compliance and reporting. The tax advantage comes from distributions, which do not pay self-employment tax. This includes 12.4% for Social Security and 2.9% for Medicare, for a punishing tax rate of 15.3%. However, owners will still pay income taxes on their entire business income.

Our S Corp vs. LLC Tax Calculator guide will explain how to tell whether an S corp election is right for your business. Read ahead to calculate your S corp tax savings when compared to a default LLC. While each situation is different, https://www.intuit-payroll.org/ there are a few common characteristics of a business well-suited to form an LLC and choose S corp taxation. Usually this happens in cases if the taxpayer took large tax-free distributions while paying themselves a very small salary.

This is tax you have to pay on any profit your business makes (revenue less expenses). There are standard and other deductions you can apply to this amount, and the total you end up paying will depend on your tax band. You will pay federal income tax on your salary, in addition https://www.accountingcoaching.online/what-is-the-current-portion-of-long-term-debt/ to employment tax. For example, suppose your LLC earns $100k with $50k expenses, leaving a $50k profit. You’ll be subject to self-employment taxes first, around 15%, and then through income taxes. This means your tax liability isn’t just dependent on your income tax rate.

Atlas will review your application and file your formation documents in Delaware within one business day. All Atlas applications include expedited 24-hour processing service at the state, for no extra fee. Atlas charges $500 for your formation and your first year of registered agent services (a state compliance requirement), and $100 each year thereafter to maintain your registered agent. LLCs and S corps are two of the most common business entities in the US.

Unlike partnerships and corporations, LLCs don’t have their own IRS tax category. Instead, they’re usually taxed in the same way as sole proprietorships or partnerships, depending on whether the LLC has one owner or multiple owners. However, an LLC can also elect to be taxed as an S corporation (if it qualifies) or a C corporation (C-corp).

- If your business does qualify, electing S-corp taxation could limit who can own an interest in your LLC and how profits can be apportioned among owners.

- If your LLC falls out of good standing due to failure to file annual reports and you decide later to reinstate it, additional reinstatement fees may need to be considered.

- While S corporations aren’t legal entities, they impose new rules on businesses electing them.

- To understand why getting taxed as an S Corporation is more tax effective, it’s useful to understand the types of taxes you will need to pay.

- Yes, S corp income passes through to the owner’s individual tax returns and is subject to state income taxes.

- In fact, a business can only elect an S corp after they’ve first registered as an LLC or other qualifying corporation.

After forming an LLC or incorporating your business, you can elect to be taxed as an S-corp. Business owners and shareholders or members can benefit from this tax status. The best LLC services make it easy for startups and small businesses to set up a limited liability company. Each partner is responsible for what they invested in the business and shares tax consequences. An LLC can be more costly to form and operate when compared to a sole proprietorship or a partnership. Also, there can be filing fees for forming an LLC and annual fees for filing annual reports.

This calculation is only valid if your business net income is $147,000 or less – if your projected net income is higher, contact us so we can provide a specialized tax savings projection. Through the check-the-box entity selection, an LLC can thus customize its tax structure to better align with its business objectives and owner’s financial circumstances. However, since this is a complex matter, it is recommended to consult with a tax professional or certified tax preparer when making these decisions. An S-corp is a tax election, and eligible LLCs can select this option.

Get started calculating your savings and share the link to your results with your tax pro today. LLCs provide a separation of personal assets from corporate liabilities. While an LLC provides restricted liability, defending personal assets against legal claims, it does not automatically bring tax benefits. Separately, an S corporation might be right for you if your company reaches a consistent level of growth. A 15.3% self-employment tax levied on an LLC’s profits is a steep tax liability to pay when revenues begin to tick upward. If you are just getting started with your business and are still unsure about how much income your LLC will generate, you may want to consider holding off on setting it up as an S-corp.